Customer retention made easy.

Convert occasional users into loyal customers: Datatrans’ Tokenisation solution lets you easily save your customers’ payment information to simplify the checkout process.

One-click payments.

Simplify follow-up purchases by enabling your customers to store their payment information with you securely and easily, and then just click-to-pay.

Minimise risk.

Tokenisation means you only store tokens rather than sensitive card information. That way, we take care of data security and you can reduce your effort and costs for PCI compliance.

Recurring purchases.

Create your own flexible subscription models and charge payment method once or recurrently via us – you set the intervals without restrictions.

Mastercard & Visa tokens.

The new service can improve your conversion rate, prevent fraud and opens doors to new, innovative applications.

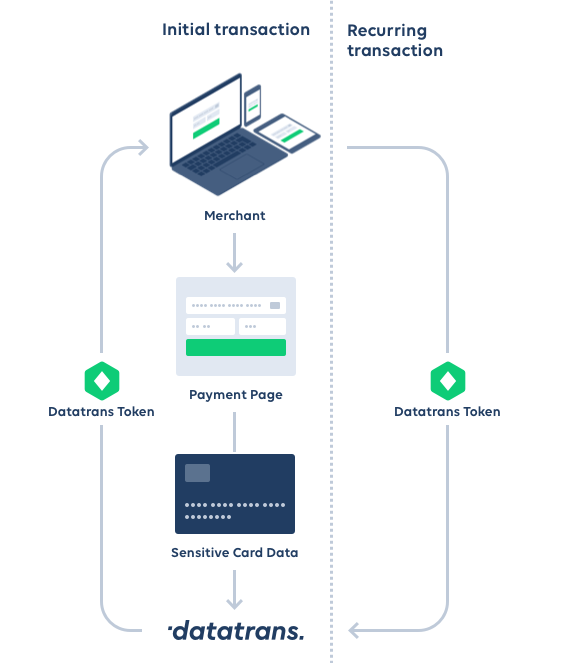

Increased sales thanks to invisible payment processes.

Repeatedly entering card information is a thing of the past. Datatrans Tokenisation converts your customers’ sensitive card information securely on their first transaction into a non-sensitive, PCI-compliant token, which you save on your systems. When it comes to follow-up purchases, all it takes is one click to pay. As a result, you offer your customers an easy shopping experience and reduce your compliance workload.

Flexibility for subscriptions.

Datatrans Tokenisation can be combined with all of our checkout solutions and integrated into your processes. You remain flexible in your pricing by using your own subscription rules and technology and only charge the stored payment methods via us.

Simple, secure registration.

Your customers will love the straightforward registration process. We provide their familiar payment methods and an automated validity check which minimises your risk of fraud and chargebacks.

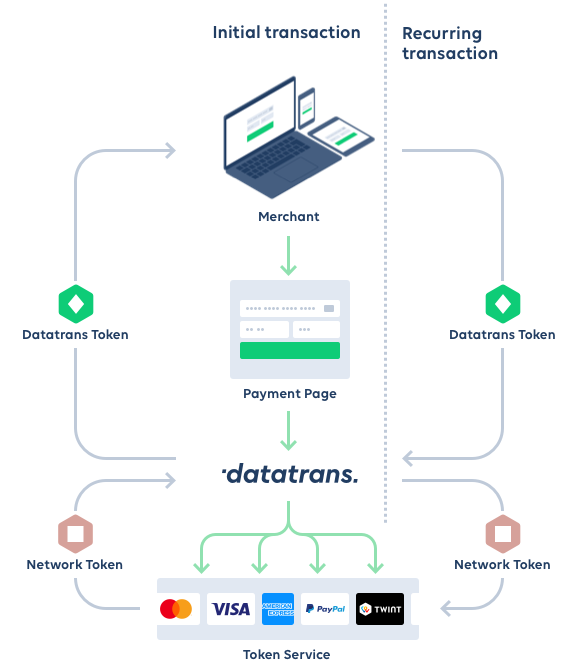

One interface for all token services.

With the Datatrans Gateway you can use the network tokens of various payment methods, including PayPal, American Express and Twint, and benefit from improved acceptance rates. You only need one integration, and we manage the token exchange with the payment providers.

Network Tokenisation with Mastercard and Visa.

The tokenisation of the two schemes promises to significantly improve the approval rate for online transactions and reduce card fraud. At the same time, it opens up new opportunities for innovative, future-oriented services for your customers.

Benefits of network tokens.

Practicality.

Cards are automatically updated or replaced when they expire, with no added hassle for you or your customers.

High conversions.

Optimum usability, high approval rates and secure network tokens reduce the risk of abandoned purchases and rejected payments.

Security.

Worry-free purchases thanks to the strictest domain controls and unique cryptogram generated for each payment.

Future-proof.

The tokens enable new applications such as push provisioning, delegated authentication, improved guest checkout, and more.

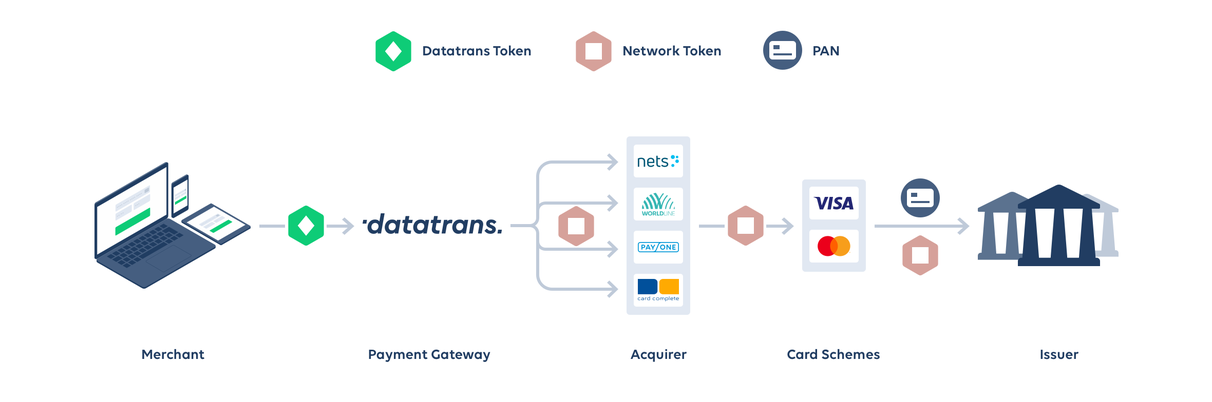

How the token application works.

We manage the tokens for you, requesting your individual network tokens from Mastercard and Visa and linking these with Datatrans Tokens. With just one interface, you benefit from all of the advantages of network tokens which are valid for all acquirers.

One technology – multiple application options.

Whether for an online shop, an app, a smartwatch, smart TV or automated payments, network tokenisation enables smooth, card-free and secure payments across all channels and lays your foundation for future innovative services and offerings for your customers.

Push Provisioning – future opportunities for optimum usability.

Using this new function, your customers connect their preferred payment method with your service by «pushing» the individual tokens directly from the issuer app. Follow-up purchases can be paid for with a simple tap or click, and you benefit from the issuer’s marketing deals such as couponing or loyalty programmes, as well as a better conversion rate and fewer rejected payments.

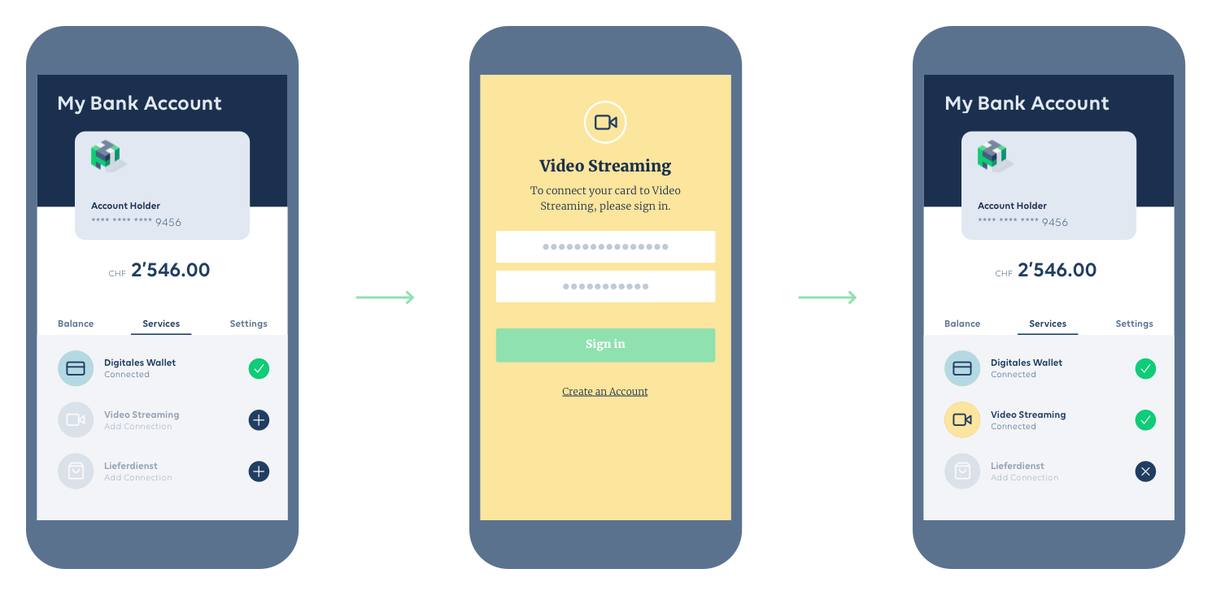

It really is that simple.

- Add provider – In their card app, your customer selects the service provider or merchant they want to connects with. All providers that support network tokens and push provisioning are displayed in the app.

- Confirm card – When the payment method is confirmed, a network token and a Datatrans Token are created and the latter is sent to you securely.

- Card ready – Your business is now connected with your customer's payment method. The network and the Datatrans Token are activated immediately.